Main Content

Real estate cycles can feel unsettling when headlines focus on slowdowns and price dips. But history tells a different story: every cooling period sets the stage for the next climb. Looking back at six decades of U.S. housing data, we see a consistent truth—downturns are temporary, and recoveries are inevitable.

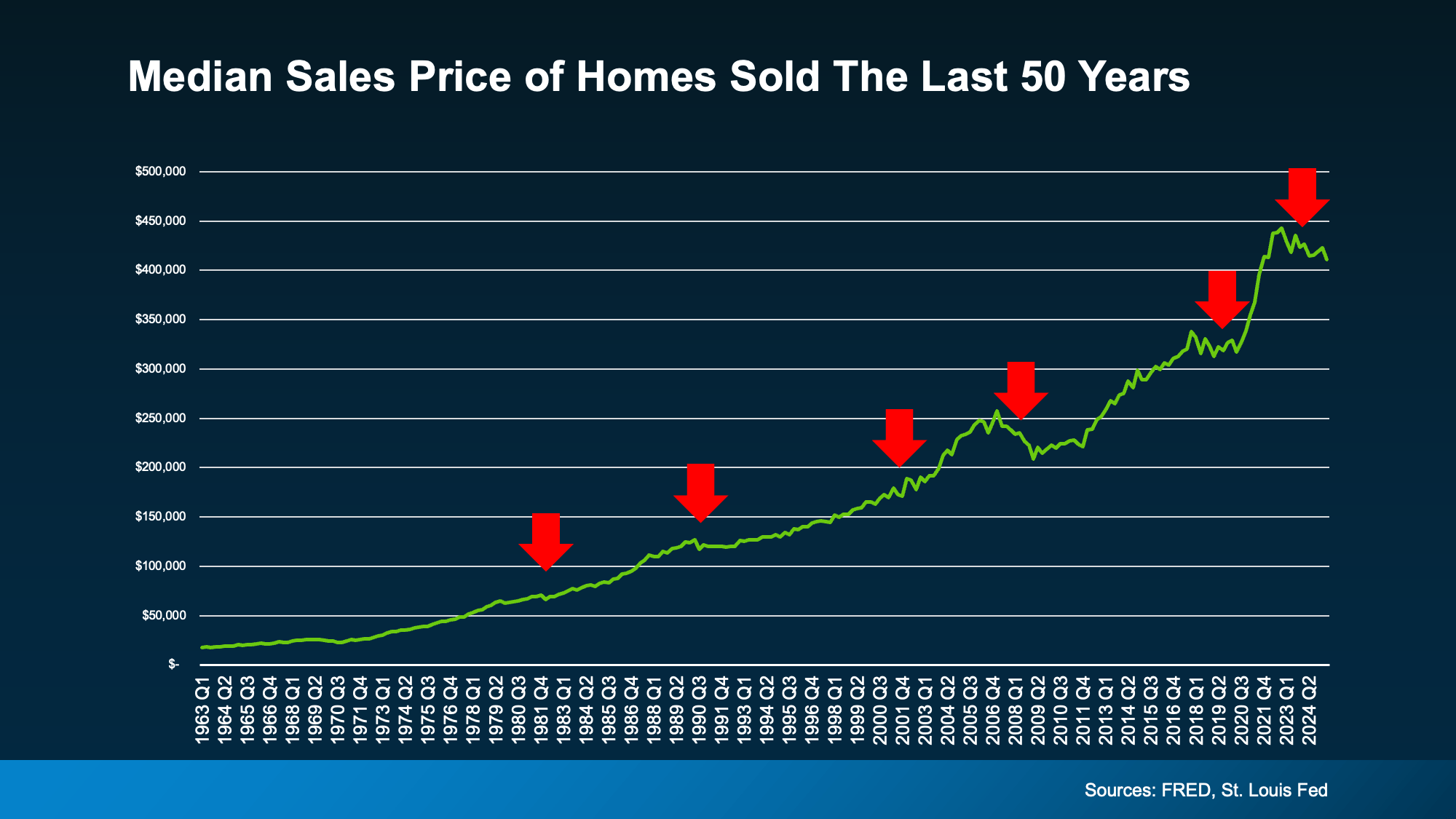

The chart above (source: FRED, St. Louis Fed) tracks the median sales price of U.S. homes from 1963 to today.

The chart above (source: FRED, St. Louis Fed) tracks the median sales price of U.S. homes from 1963 to today.

Red arrows highlight every major slowdown or recessionary period:

- Early 1980s recession

- Early 1990s slowdown

- Early 2000s dot-com/9-11 dip

- 2008 Great Financial Crisis

- 2020 COVID disruption

- And the current 2024–2025 cooling phase

Despite these dips, the green trend line climbs steadily upward over six decades. The message is clear: short-term declines have never stopped long-term growth in home values.

Learning From Past Cycles

Consider the two most dramatic downturns:

- Early ’80s recession: Home sales fell from 4 million to 2 million—a 50% drop—but recovered within four years.

- Great Financial Crisis (2008): Sales dropped from 7 million to 3.5 million—a 51% decline—but rebounded in three years.

COVID’s brief disruption in 2020 also followed this pattern: a sharp dip and an equally strong rebound.

These historical markers prove that every drought in housing eventually turns to growth.

Today’s Market: Where We Stand

Now, in late 2025, we’re in another cooling period:

- Home prices are mostly flat or slightly down.

- Mortgage rates are drifting lower—but slowly.

- Remember the adage: “When mortgage rates go up, they take the escalator. When they come down, they take the stairs.”

That’s exactly what we’re seeing today.

Current forecasts point to roughly 4 million existing-home sales for 2024 and 2025, with 4.5 million projected for 2026—a sign that recovery is already taking shape.

Looking Ahead: 2026 and Beyond

The Home Price Expectation Survey, which aggregates both optimistic and conservative forecasts, shows consensus in one direction: up.

Expectations include:

- Gradual price appreciation as we enter 2026

- Sustained buyer demand as mortgage rates ease

- A rebound in existing-home sales volume, fueling renewed market energy

In other words, the market’s long-term fundamentals remain strong.

Takeaways for Buyers and Sellers

- Sellers: Today’s slower market is temporary. Well-priced, well-marketed homes will still sell—and likely at higher values in the next cycle.

- Buyers: Slightly lower prices and more negotiating room create an opportunity before appreciation resumes.

Bottom Line

History is unambiguous: every housing downturn ends in a recovery.

Whether recovery takes eight months, three years, or four years, the overall trajectory of U.S. home prices continues upward.

The key is perspective. By staying focused on long-term fundamentals—steady demand, limited inventory, and the enduring value of homeownership—buyers and sellers can make confident decisions even in a cooling market.